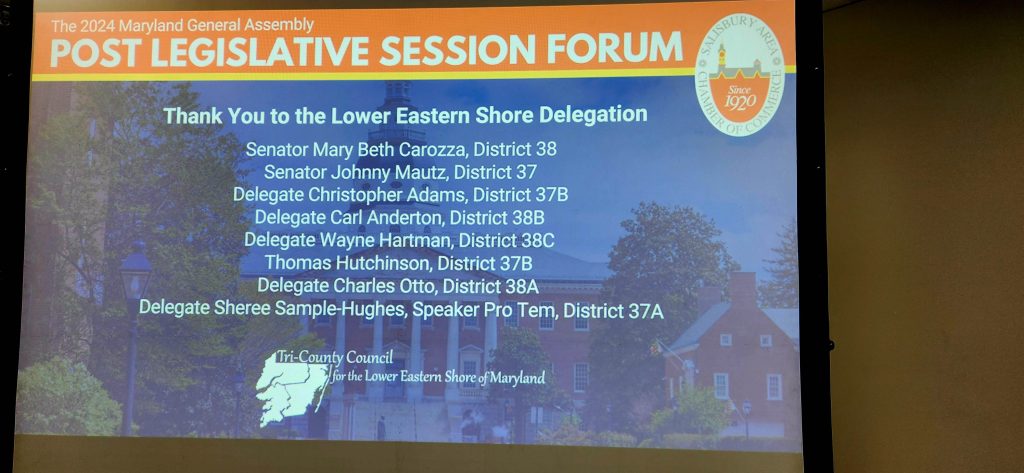

The SACC hosted its annual review of the 2024 Maryland General Assembly Session with the Lower Shore Legislative Delegation on Wednesday, April 24th at the Wicomico Civic Center. The event was presented by Tri-County Council for the Lower Eastern Shore.

More than one hundred business and civic leaders attended the forum to hear from legislators on information on pieces of legislation and issues they dealt with during the 90-day session in Annapolis.

Among the topics covered by the delegation members was the House of Delegates’ proposed tax hike. If passed, Fair Share for Maryland Act of 2024 (HB1007) would have resulted in massive tax increases across the board in Maryland.

House of Delegates member Wayne Hartman thanked Chamber members for their assistance in killing the Sales and Use Tax – Rate Reduction and Services bill (HB1515) by making phone calls and sending emails and letters.

Hartman cautioned “This bill will come back as a pick-and-choose bill to tax services on the Marylanders.”

Delegate Chris Adams added “This bill was irresponsible as it would have added a 5% tax on labor for essential services. Let’s advance a state budget that does not include new taxes and deal constructively with the $3 billion structural state deficit that’s looming in three years.”

Delegate Charles Otto also added, “Advocacy from the Salisbury Area Chamber and the State Chamber made a difference. Those calls and emails are effective.”

The Blueprint for Maryland Education initiative (Kirwan) also drew comments from the group addressing the future cost burdens to all citizens moving forward.

Senator Mary Beth Carozza reminded the audience that Kirwan and the costs associated with implementation are not new news, “From the beginning, I stated that the Blueprint can’t be one size fits all. It lacked local control. It is not affordable, and at this point, I think it is okay to extend the implementation timeline given the cost burdens.”

Senator Johnny Mautz agreed and added, “Let’s not forget the Cade funding formula for our community colleges. The public schools and community colleges are intertwined.”

Delegate Carl Anderton also agreed and joked “If 10% is alright for Jesus then it should be alright for all Marylanders,” suggesting that the Blueprint tax burden will inevitably be passed on to Maryland taxpayers.

Delegate Tom Hutchison lamented the entire cost of fully implementing the Blueprint, “The shore counties just simply cannot afford Kirwan in its current form.”

Another topic of discussion was Maryland’s competitiveness as compared with the rest of the United States.

Chamber Board Chair and moderator Zach Evans asked for feedback on the fact that Maryland is ranked 42nd in the country for having a business-friendly environment, according to a report produced by the Tax Foundation.

Delegate Hartman noted that he has co-sponsored legislation in the past two sessions that would gradually move Maryland’s corporate tax rate from 8.3% to 6.2%.

“My bill, the Economic Competitiveness Act of 2024 (HB1282), would make the business climate in Maryland much more competitive. Our neighbors in Pennsylvania and Virginia have already lowered their corporate tax rates to attract new business to their states.”

Delegate Otto added, “Maryland is a great place to live, but our tax structure drives folks away, especially retirees and businesses.”

Regarding Maryland’s growing 63 billion dollar budget, Senator Mautz asked, “Where are the incentives for all state agencies to manage their funds and make budget cuts within their agencies? The spend-it-all-every-year mentality has to cease.”

In closing, Delegate Adams summed up some of the challenges that lie ahead, “Spending issues aren’t just local. Look at the real estate assessments that have doubled statewide. These increases are not implemented through the legislative process but rather by the Governor’s administration. At some point, initiatives, including the cost to implement the Blueprint, will have to come from the taxpayers of Maryland’s twenty-six counties.”

The SACC wishes to thank the entire Lower Shore Delegation and event sponsors, 47abc WMDT, Chesapeake Utilities, Pohanka Automotive Group of Salisbury, Salisbury University, University of Maryland Eastern Shore, and Wor-Wic Community College.

L to R: Bill Chambers, Aaron Guy, Greg Padgham, Delegate Wayne Hartman, Senator Johnny Mautz, Delegate Chris Adams, Delegate Carl Anderton, Delegate Tom Hutchinson, Delegate Charles Otto, Senator Mary Beth Carozza