Maryland lawmakers face tough budget decisions that could include program cuts or tax increases when they return to Annapolis in January.

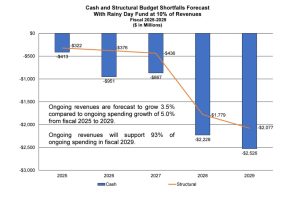

Members of the joint Spending Affordability Committee were briefed on a budget picture that sees hundreds of millions in structural deficits balloon to $2 billion by fiscal 2029. That picture raised the specter of tax increases.

Some members of the committee were unperturbed by the briefing.

Sen. James C. Rosapepe (D-Prince George’s and Anne Arundel). Photo by Bryan P. Sears.

“The structural deficit grows somewhat in the following two years,” said Sen. Jim Rosapepe (D-Prince George’s and Anne Arundel), co-chair of the joint Spending Affordability Committee. “And then as we’ve always known, when the next round of Kirwin [a nearly $4-billion education reform plan called the Blueprint for Maryland’s Future] kicks in, it’s got to be paid for somehow. So, I think it was all pretty predictable. I don’t think it’s anything particularly surprising.”

Tuesday’s briefing is the first of several meetings of the committee that will make recommendations on budget growth to the governor. The recommendations are non-binding.

Over the next five years, revenues are expected to grow 3.5% annually. Those are outpaced by expected spending growth of 5% annually over the same period.

The difference creates a structural imbalance that must be resolved. Maryland’s constitution requires a balanced budget.

In the recent past, the state benefited from federal aid during the COVID-19 pandemic. Those dollars flooding state coffers created historic budget surpluses.

Those surpluses have run their course.

“The coming year’s budget is more like a normal year’s budget where revenues and projected spending are pretty close to each other,” Rosapepe said.

Analysts project the state will have to deal with a structural gap of $322 million in the coming legislative session. Projections show the gap continuing to grow in fiscal 2026 and 2027 to $376 million and $436 million respectively.

By fiscal 2028, the gap would grow to nearly $1.8 billion followed by a nearly $2.1 billion deficit the following year.

Driving much of the gap in those last two fiscal years are large increases in spending related to implementing the Blueprint education reforms.

A trust fund for the program will be exhausted and the state will have to use more general fund dollars to pay for it.

House Minority Leader Del. Jason Buckel (R-Allegany). File photo by Danielle E. Gaines.

“We have to start getting realistic with ourselves, with the voters and the citizens of the state,” said House Minority Leader Del. Jason Buckel (R-Allegany), a member of the joint committee. “We can’t afford the Blueprint plan. Many of us in the legislature said this a few years ago: that it sounds great, it would be wonderful if we were flush with world-record revenues and we could make cuts in other places. But the truth is we’re not on either of those fronts. We can’t afford the Blueprint spending, both at the state level and at the local level.”

Without cuts, Buckel said the only other option would be tax increases.

“Unfortunately, what I think we also heard was discussions of the only way to combat this is to increase revenues,” Buckel said. “And you know, I think we’ve proven in Maryland over the past 10 to 20 years that that doesn’t work. The more revenues you give to the state government, the more revenues they will spend. Ultimately, it will never be enough, and you’ll need more revenues.”

Legislative analysts said lawmakers have three options to deal with the projected gaps between expected spending and projected revenues.

The first is to reduce spending to sustainable levels. Another option would be to spend down the state’s so-called rainy-day fund. The final option would be to increase revenues.

Spending down the state’s reserves represents a one-time fix and could cause problems in the future in the event of a recession.

Del. Stephanie Smith (D-Baltimore City) said the idea of “aggressive cuts” to state programs including education, mental health and others was unpalatable. Similarly, she rejected the idea of spending down the state’s rainy day fund.

“It’s not exactly raining yet,” said Smith, who is a member of the joint committee.

Instead, Smith said, the legislature “should not forgo a conversation about getting the resources we need in the next session to ensure that we have the funds we need in outlying years for the big, bold commitments we’ve made to the people of Maryland.”

Benjamin Orr, president and CEO of the Maryland Center on Economic Policy, called on lawmakers to close “corporate tax loopholes,” including requiring combined reporting, as have a majority of states that levy some form of corporate tax.

“The choice is clear,” Orr said. “We should maintain our commitment to improving our public schools and providing a great education for every child. We need to move forward with transit projects like the Red Line and Southern Maryland rapid transit so that more people can get to good jobs and our economy can continue to grow.”

Tax and fee increases are often considered in the second year of a term lawmakers as prefer not to put them on the table close to an election. Some lawmakers expect the legislature, during its coming session, to debate levying fees on electric and hybrid vehicle owners to bolster the state’s Transportation Trust Fund.

It is not clear if there is an appetite for debating full blown tax increases.

Rosapepe said the discussion may hinge on Gov. Wes Moore (D). During the previous eight years, then Gov. Larry Hogan (R) opposed any tax or fee increase, although the legislature, dominated by Democrats, could ignore that opposition as they desired.

“I think, now we have a Democratic governor, let’s just be straight about it, who is obviously working much better with the legislature than his predecessor did,” said Rosapepe. “I think everyone’s going to want to see what the governor wants to do. Because to make significant changes in budget policy. You need the governor working with the legislature and I don’t know where the governor is on this stuff at this point.”

Moore, through a spokesperson Carter Elliott, vowed collaboration with the legislature.

“Marylanders have come to expect fiscal responsibility from the Moore-Miller Administration and the governor will continue to move forward with that at the top of mind as he works hard to not add additional burdens on working families at a time of high inflation and potential economic headwinds,” Elliott said.