Five-Point Framework Includes Retirement Tax Relief, Direct Tax Relief, Additional Relief for Underserved Marylanders, Enhancements for State Employees

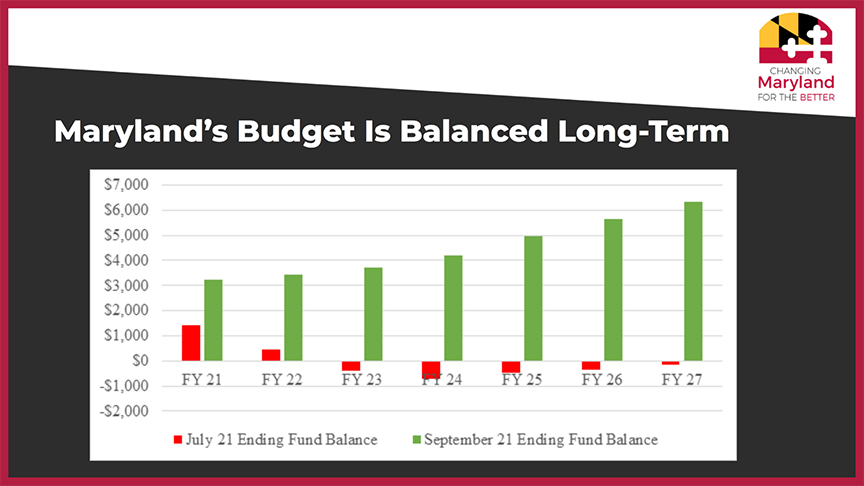

Maryland Projecting Long-Term Balanced Budget For First Time Since FY99

Governor Larry Hogan today announced a five-point framework for how the State of Maryland will utilize the $2.5 billion surplus—the largest in state history—reported last week by the Bureau of Revenue Estimates. The framework builds on the governor’s record of fiscal discipline while prioritizing relief that advances the state’s recovery.

“The entire mission of my administration has been to leave our state in a stronger fiscal position than when we found it, and that is exactly what we have done,” said Governor Hogan. “With this budget framework, my message is simple—as long as I am governor, I will continue to fight for fiscal discipline, I will continue working hard every single day to make it easier for Maryland families, small businesses, and retirees to stay in our state, and I will continue fighting to allow Marylanders to keep more of their hard-earned money in their own pockets so that we can continue changing Maryland for the better.”

Watch today’s press conference.

View the slides from today’s press conference.

This is the first time since Fiscal Year 1999 (FY99) that the State of Maryland is projecting a long-term balanced budget.

The governor’s five-point plan to invest Maryland’s record surplus includes:

Increasing the Rainy Day Fund. The governor’s plan will bolster and increase the state’s Rainy Day Fund to at least 7.5%, or $1.67 billion, in order to have extra revenue available for potential recessions and future crises.

Major Tax Relief for Retirees. The governor will again seek to address the crippling tax burden on retirees, which continues to hurt Maryland’s ability to compete effectively with other states. The Hogan administration has introduced legislation each year to provide this much-needed relief, but the legislature has failed to take action.

Direct Tax Relief for Marylanders. Governor Hogan’s plan includes additional direct tax relief for working families across the state. This would build on the success of the RELIEF Act of 2021, which included the largest tax cut in state history.

Additional Relief for Underserved Marylanders. As the state continues to recover from the COVID-19 emergency, Governor Hogan announced his intention to continue to provide additional targeted relief for Marylanders who are struggling to make ends meet.

The State of Maryland has already sent more than 420,000 direct relief checks to Marylanders in need and more than $100 million in additional grants to small businesses and nonprofit organizations. Maryland has committed more federal funds from the American Rescue Plan Act of 2021 than nearly any other state, distributed more than $14.1 billion in unemployment aid, and committed more than $248 million in rental assistance.

Enhancements for State Employees. With fall negotiations for collective bargaining for public employees about to begin, Governor Hogan has directed the Maryland Department of Budget and Management to explore how to best utilize some of the available funds to benefit state employees.

-###-