Maryland business leaders say 3% tech tax will hurt businesses, Maryland’s competitiveness.

- Maryland lawmakers are considering a revised budget proposal that includes tax increases and fee hikes.

- The proposal aims to address a budget deficit.

- Some proposed taxes, such as a sugary drink tax and a delivery fee, have been removed from the revised budget proposal.

- New taxes under consideration include a tech tax and increased taxes on sports wagering and cannabis.

- The proposal has drawn criticism from some business leaders who argue it will harm Maryland’s business climate.

With two weeks to go before the end of the Maryland legislative session, lawmakers are to consider a revamped budget proposal announced late last week that changes some of the tax proposals and increases some consumer fees or taxes that will affect residents and consumers.

The proposed increases include sports wagering and cannabis taxes and increases for vehicle registration and emissions test fees.

Gone are the proposed tax on sugary drinks, the 75-cent fee on retail deliveries such as Amazon and Uber Eats, and the broad-based 2.5% business-to-business tax.

What’s new in the proposed budget framework is a 3% sales tax on data/IT services and to apply the state’s 6% sales tax to vending machine sales.

Lawmakers and business experts were still trying to figure out the details on some of the changes announced Thursday when Gov. Wes Moore, Senate President Bill Ferguson and House of Delegates Speaker Adrienne A. Jones held a news conference to announce they had agreed on a proposed framework for the state budget.

The Senate Budget and Taxation Committee was scheduled to discuss the budget and proposed changes on Tuesday afternoon.

Three things Moore stressed late last week about the proposed framework is that it would provide key investments to grow and diversify the state economy, turn the state’s more than $3 billion deficit into a surplus, and ensure 94% of Marylanders will get a tax cut or see no change at all with their state income taxes.

The governor’s office provided the following statement Tuesday morning, “The governor will continue to work with the State Legislature, local leaders, and all partners involved to ensure that we pass a budget that will give middle class families a break, grow our economy, and protect and invest in our people.”

Del. Matthew Schindler, D-Washington, who sits on the House Appropriations Committee, said Monday that funding for phase 2 of widening Interstate 81 in Washington County was still in the proposed budget.

Schindler said he was glad to see some of the cuts and proposed taxes in the original proposed budget lessened, but acknowledged there are around $2 billion in cuts as well as proposals to raise some fees and taxes due to the fiscal state Maryland is in.

Most of the Developmental Disabilities Administration funding originally proposed to be cut has been restored in the proposed budget, he said.

The state had already proposed passing on some costs to local jurisdictions, including a greater share of educator pension costs and expenses for the local assessment office.

For Washington County, those increased costs include almost $4.5 million for Washington County Public Schools teacher retirement costs, $165,137 for Hagerstown Community College retirement costs and $543,828 for the local assessment office, according to an email from Kelcee Mace, the county’s chief financial officer.

Before the latest budget proposal revision, proposed state changes to income tax and deductions would have cost Washington County an estimated $5.1 million in revenue, Mace said. She had not received an updated revenue figures since the proposed budget framework had changed, she said Monday.

What tax changes are in Maryland’s proposed budget framework?

The proposed budget framework, which still needs to be considered for approval by the House of Delegates and State Senate, includes:

- Increasing the standard tax deduction to $3,350 for single tax filers and to $6,700 for joint tax filers for tax year 2025.

- Phasing out itemized deductions for people with a federal adjusted gross income of more than $200,000.

- Adding two new tax brackets for taxable income. For those earning between $500,001 and $1 million, the tax rate would be 6.25%. For those earning at least $1,000,001, the tax rate would be 6.5%.

- Creates a new 2% surcharge on capital gains income over $350,000. That is expected to generate an estimated $367 million in revenue, with $138 million going to the Transportation Trust Fund and $229 million going to the state general fund.

- Increases the sports wagering tax from 15% to 20%, generating an estimated $32 million more for the general fund.

- Creates a 3% sales tax on data/IT services that is estimated to generate $497 million for the general fund.

- Increases the cannabis tax rate from 9% to 12%, generating an estimated $39 million more in revenue.

- Applies the 6% sales tax to vending machine sales to generate an estimated $9 million in revenue.

- Increases the maximum local income tax rate allowed from 3.2% to 3.3%. Among the counties already charging the maximum 3.2% local income tax rate are Somerset and Wicomico counties. Washington County’s tax rate for 2024 was 2.95%, while Worcester County’s was 2.25%.

- Repeals a sales tax exemption for sales of photographic and artistic material used in advertising.

- Repeals a sales tax exemption for sales of precious metal coins or bullion over $1,000 with an exemption for sales at the Baltimore City Convention Center.

- Reduces the cap on the film production activity tax credit for fiscal 2026 from $20 million to $12 million.

What transportation-related fee or tax changes are in Maryland’s proposed budget framework?

The proposed state budget framework also includes several tax and fee changes to benefit state transportation revenue. They include:

- Increasing the excise tax on vehicles to 6.8%, generating an estimated $158 million in revenue.

- Speeding up the annual vehicle registration fee increases for Class A passenger, Class M multipurpose and Class E trucks by a year so they go into effect for fiscal 2026.

- Increasing the maximum VEIP (Vehicle Emissions Inspection Program) fee from $14 to $30 to generate an estimated $20 million more in revenue.

- Changing the definition of a historic vehicle, for historic tags, from being at least 20 years old to being older than the 1999 model year. This is estimated to generate $9 million more in revenue.

- Repealing the excise tax exemption on short-term vehicle rentals and creating a 3.5% excise tax that could generate $47 million in revenue.

- Doubling the certificate of title fees for a new or used vehicle to $200.

Opposing views on Maryland’s business climate

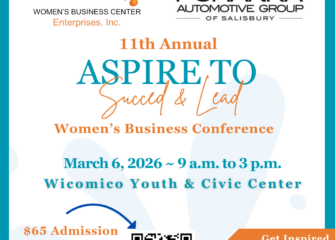

The president and CEOs of the Washington County Chamber of Commerce and Salisbury Area Chamber of Commerce were among those to express concern about the effect of the proposed 3% tech tax.

Washington County Chamber President and CEO Paul Frey said that, according to the Maryland Chamber of Commerce’s Redbook, Maryland already ranks 46th in the nation regarding overall state business tax climate. The annual Redbook ranks Maryland competitiveness among key business climate indicators.

During the March 20 news conference, Moore repeatedly said Maryland was moving to be more business friendly. He also said the state needs to diversity its economy because it can no longer count on the federal government to sustain Maryland’s economic growth.

Moore said that according to the credit rating agency Moody’s, the federal cuts under the Trump Administration pose a greater threat to Maryland than any other state.

According to USAFacts.org, 4.6% of Maryland’s workforce in 2023 was federal employees. That represented about 142,876 jobs, according to data from the US. Office of Personnel Management.

Del. William Wivell, R-Washington/Frederick, said he was surprised how often Moore and others at last Thursday’s news conference brought up President Trump’s name.

“We knew about the $3 billion (state) deficit long before Trump was elected,” Wivell said. That deficit has increased about $300 million in the last month, but Maryland’s majority party — Democrats — “owns the rest of it,” he said.

Wivell said he thinks it’s wrong to consider raising taxes when states around Maryland are doing well by reducing regulations and cutting taxes.

He said he expects to continue seeing Maryland lose businesses to other states because Maryland is not competitive. The state has too long relied on the federal government and adopted anti-business regulatory policies over the years, he said.

The Lower Eastern Shore’s manufacturing region, including the poultry industry, rely heavily on tech services, said Bill Chambers, president and CEO of the Salisbury Area Chamber of Commerce.

“This is not the agricultural days of your mom and dad,” Chambers said. The ag industry, including poultry, grains and crops, has become “pretty sophisticated,” he said.

The Salisbury chamber’s more than 700 members believe the state needs to tighten its belt even more instead of relying on the business community to help balance the state budget, Chambers said.

The previously proposed 2.5% business-to-business tax would have been a killer, but Moore agreed it would hurt businesses, Chambers said. Now there is a proposed 3% tech tax that will be passed onto end users, in most cases businesses, he said.

About 82% of Maryland businesses are small businesses, he said. They don’t have a line item in their budget for a new tax.

Frey said family-owned businesses already have thin margins and will get hit the hardest.

Frey referred to a recent Baltimore Sun report about state payroll outpacing inflation over the past 10 years, but that states Moore and lawmakers are proposing to “largely cut from areas outside state salaries.”

In the private sector, the first thing businesses do is look at payroll and payroll benefits, but the state is not doing that, Frey said. The state can raise taxes to generate income, while businesses have to reduce expenses or provide better services to improve their financial situation, he said.

Businesses need less government intervention, Frey said.

If the 3% tech tax passes, then the regulations will get written and businesses will see who is included and who is left out, Chambers said.

A Maryland Chamber of Commerce release lists several services that could be affected, based on initial reports.

Those include cloud storage and application hosting like Google Drive, DropBox and iCloud; web search portals and online directories like Google; robotics and AI software design and support; website and software development services; IT consulting and cybersecurity solutions; video game design and publishing; custom enterprise software solutions, and computer disaster recovery and data security services.

That list also include video and audio streaming support for businesses like Netflix and YouTube.

According to the House Speaker’s office on Tuesday, the tech tax does not apply to cell services or tv streaming services.