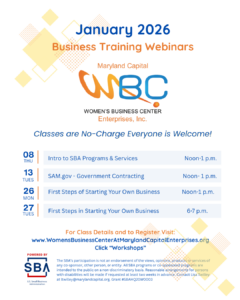

Salisbury, MD — Maryland Capital Enterprises’ Women’s Business Center (WBC) is proud to launch the new year with a robust lineup of free, online business training classes in January 2026, designed to support aspiring entrepreneurs and established small business owners at every stage of growth.

As an official U.S. Small Business Administration (SBA) Resource Partner, the WBC provides trusted education, tools, and guidance to help individuals start, sustain, and grow successful businesses. All January classes are free of charge and open to the public.

Registration Information

All classes are free, but advance registration is required.

To register and view the full calendar of upcoming programs, visit: https://marylandcapital.org/education/

Introduction to SBA Programs & Services

Thursday, January 8, 2026 | Noon – 1:00 p.m. | Online

Hosted by Maryland Capital Enterprises’ Women’s Business Center and presented by the SBA Baltimore District Office, this informative session introduces participants to the wide range of assistance available through the SBA.

Topics include:

- Counseling and training resources

- SBA financing programs

- Government contracting assistance

- Program benefits, eligibility requirements, and how to access services

- This webinar is free and open to everyone interested in learning how the SBA can support their business journey.

SAM.gov Simplified: Federal Work & Grants

Tuesday, January 13, 2026 | Noon – 1:00 p.m. | Online

Speaker: Roslyn Davis, PMP, DASM

U.S. Air Force Chief Master Sergeant (Ret.) President & CEO, RoDa Business Solutions

This practical session breaks down the federal registration process and helps business owners understand how to pursue federal contracts and grants.

Participants will learn:

- How to complete and maintain a SAM.gov profile

- How to position a business for federal opportunities

- How to determine eligibility to bid on and accept federal work

First Steps of Starting Your Own Business

Monday, January 26, 2026 | Noon – 1:00 p.m. | Online

Speaker: Nick Rudolph

Baltimore Regional Director, Maryland Capital Enterprises

This introductory webinar is ideal for individuals considering entrepreneurship or in the early stages of launching a business.

Topics include:

- Pros and cons of small business ownership

- Skills and resources needed to succeed

- State of Maryland requirements for starting a business

- Why good credit matters

- The importance of a solid business plan

MBE / DBE / SBE Certification Workshop – Two-Part Series

Part 1: Tuesday, January 27, 2026 | Noon – 1:00 p.m. | Online

Part 2: Tuesday, February 3, 2026 | Noon – 1:00 p.m. | Online

Instructor: Roslyn Davis, PMP, DASM

U.S. Air Force Master Sergeant (Ret.) President & CEO, RoDa Business Solutions

This two-part workshop provides a comprehensive overview of the MBE (Minority Business Enterprise), DBE (Disadvantaged Business Enterprise), and SBE (Small Business Enterprise) certification process. Participants should register for each session individually.

Part 1 focuses on:

- Understanding the application process

- Submitting complete and accurate documentation

- Business ownership and control requirements

- Financial statements and key personnel resumes

- Required licenses, forms, and insurance

For questions, please contact Lisa Twilley at ltwilley@marylandcapital.org.

About Maryland Capital Enterprises Women’s Business Center (MCE WBC):

MCE WBC provides training, resources, and support for small business owners and aspiring entrepreneurs.

This program is supported by the U.S. Small Business Administration.

SBA’s participation in this cosponsored activity is not an endorsement of the views, opinions, products or services of any cosponsor or other person or entity. All SBA programs and services are extended to the public on a nondiscriminatory basis. Reasonable arrangements for persons with disabilities will be made if requested at least two weeks in advance. Contact rachel.skinner@sba.gov.